Bylaws

BY-LAWS OF GREAT EAST LAKE IMPROVEMENT ASSOCIATION

As Amended August 2021

ARTICLE I – Name

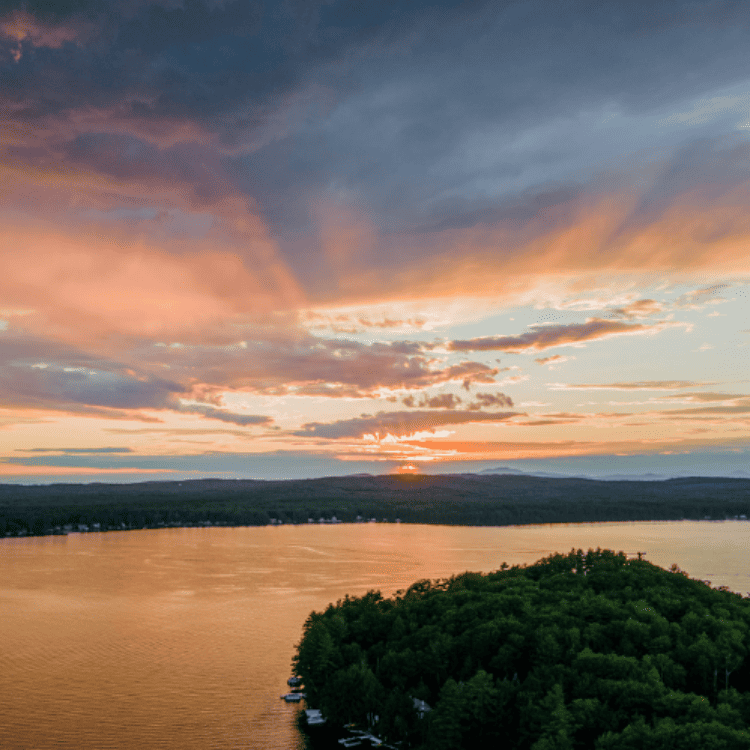

The name of this corporation shall be Great East Lake Improvement Association.

ARTICLE II – Purpose

The purpose of this Association shall be (1) to perform all acts appropriate to a non-profit scientific, literary and educational corporation dedicated to the promotion and development of environmental quality standards; and (2) to preserve, enhance and protect the advantages of Great East Lake and its environs.

ARTICLE III – Membership

A. The members of the Corporation shall consist of all who subscribe to its purposes and pay dues by the date of the annual meeting, in their appropriate membership category, such categories to be determined by the Board of Directors. A membership shall include no more than two adults residing in the same domicile and any of their dependents residing with them.

B. Each Adult included in a membership unit shall be entitled to vote in person at any membership meeting.

ARTICLE IV – Dues and Assessments

A. The Board of Directors shall have the power to set the amount of the annual dues.

B. Special assessments may be levied by a simple majority vote of the members present at any annual or special meeting of the membership.

ARTICLE V – Officers and Directors

A. Officers and Directors. The officers of the Corporation shall consist of a President, a Vice-President, a Treasurer and a Secretary, all of whom own property on, or deeded access to, Great East Lake. The Board of Directors shall consist of the officers, the most recent past-president, and no fewer than five and no more than twenty other members. No person may serve as officer or director unless he or she is a member of the Corporation as described in Article III.

B. Election. All officers and directors shall be elected by the members of the Corporation at its annual meeting and shall hold office for the terms stipulated hereinafter.

C. Vacancy. Any vacancy may be filled by the Board of Directors until the next annual meeting, and between annual meetings the Board may elect additional directors, not to exceed the maximum herein prescribed, to serve until the next annual meeting.

D. Removal. Any officer or director may be removed from office by vote of the Board of Directors if his or her membership dues remain unpaid three months after dues notice or if such officer or director fails to attend, without reasonable justification, more than 50% of the Directors Meetings called during the prior year in accordance with these By-Laws, or fails to uphold the purposes of the corporation.

E. Term.

(1) The President and Vice-President shall hold office for a term of two years and shall not server more than one consecutive term in that capacity except if elected by the members of the corporation after nomination for one additional term which has been approved by two-thirds of the directors prior to the annual meeting. Reasonable effort shall be made to ensure that the office of the President shall be filled by a Property Owner from Acton, Maine, and a Property Owner from Wakefield, New Hampshire, on an alternating basis to the extent that it is practicable, and to elect a Vice-President who is a property owner in the town not represented by President. Property Owner is herein defined as an individual owning property, the spouse or child of an individual owning property, the trustee or beneficiary of a trust owning property, or the spouse or child of the trustee or beneficiary of a trust owning property.

(2) The Treasurer and Secretary shall hold office for a term of two years and shall not serve for more than two consecutive terms with the same conditions controlling further service set forth herein for the President and Vice-President.

(3) Directors shall be elected for a term of two years unless they are filling the unexpired term of a director who has resigned, been removed, or is no longer able to serve. Directors shall be limited to three consecutive two-year terms.

(4) No board member may serve in any capacity for more than 10 consecutive years.

F. Duties.

(1) The President shall act as Chief Executive Officer of the Corporation, shall preside at meetings of the Members and the Board of Directors, and shall perform such other duties as may be required by law, by vote of the Board of Directors or by these By-Laws. It shall be incumbent on him or her to keep the directors informed of significant activities and between directors meetings to keep the Executive Committee so informed.

(2) The Vice-President shall perform all the duties of the President in his or her absence or inability to act, and other duties as assigned by the President.

(3) The Treasurer shall have custody of the Corporation’s funds, books and accounts; shall keep or cause to be kept true and accurate account of all moneys received and paid out by the Corporation; shall sign checks and monetary obligations of the Corporation; shall submit a report at the annual meeting of the Corporation,. and at any Board of Directors meeting upon request of same, and perform such other duties as are required by law, by vote of the Directors, or by these By-Laws.

(4) The Secretary shall keep full and accurate records of the meetings of the Corporation and of the Board of Directors and perform such other duties as are required by law, by vote of the Board of Directors, or by these By-Laws. He or she shall have custody of the records of the Corporation, excluding the financial records.

(5) The Board of Directors shall have the management of the business of the Corporation and may appoint such agents or employ such persons as in their judgment may be necessary for carrying out the purposes of the Corporation. They may delegate to any of the officers such of their powers as are not required by law or these By-Laws to be exercised by the Board. The Board may exercise all such powers of the Corporation and do all such lawful acts as are not required by law or these By-Laws to be exercised by the members of the Corporation. The Board of Directors may assign additional duties to any officer.

ARTICLE VI – Committees

A. A Nominating Committee made up of three members, one of which shall be a member of the Corporation who is not a Director, shall be appointed by the Board of Directors at least three months prior to the Annual Meeting. No member of the Nominating Committee may be appointed for more than two consecutive two year terms. Not less than 31 days prior to the Annual Meeting, the Nominating Committee shall submit to the Secretary a slate of candidates who have indicated their willingness to serve as officers or directors. The slate shall be sent to members with the Notice of Meeting. With the support of at least five members of the Corporation, additional nominations of persons willing to serve may be made from the Floor of the Annual Meeting. The names of any such nominee and the five members who support the nomination shall be given in writing to the secretary before the meeting is called to order.

B. An Executive Committee shall consist of the officers of the corporation and the most recent past-president. It shall meet at the call of the President or any two members of the Committee, with approval of a majority of the directors. It shall have the power to conduct the affairs of the Corporation as may be necessary between meetings of the Board of Directors, unless the law or these By-Laws require the vote of the members of the corporation.

C. Special Committees shall be designated by the President, with the approval of the Directors, who will appoint chairpersons from among the directors. Committees shall be empowered to add to their membership as the need arises, with the approval of the Board of Directors. It shall be incumbent upon each chairperson to enlist the involvement of all members of his/her committee in the performance of the work for which the committee is designated. The chairperson shall keep the Board of Directors informed of the committee’s activities.

ARTICLE VII – Meetings

A. The Annual Meeting of the corporation shall be held on the first Saturday in July at Wakefield, New Hampshire, or at such other time and place as may be determined by the Board of Directors and set forth in the Notice of Meeting. The purpose of said meeting shall be to report to members the activities of the Corporation during the preceding fiscal year, its projected activities for the current year, and its financial affairs, to discuss matters pertinent to the purposes of the corporation, and to elect officers and directors for the following fiscal year.

B. Any business relating to the affairs of the corporation may be acted upon at the Annual Meeting without specifying the same in the Notice of Meeting, except that no change in the By-Laws shall be made unless notice thereof is given with the Notice of Meeting.

C. A Special Meeting of the Corporation shall be called by the Secretary whenever so directed by vote of the directors, or whenever requested by 20 or more members who shall unite in a written request to the Secretary stating the purpose for which the meeting is desired.

D. At least 31 days prior to the date of any membership meeting, a Notice of Meeting shall be sent to all members at the most recent addresses provided to the Secretary by the members. It shall be the responsibility of each member to keep the Secretary informed regarding his or her proper address and to make arrangements for the forwarding of mail as the need arises.

E. Thirty members whose dues and assessments have been paid, present and voting in person shall constitute a quorum at any Membership meeting.

F. Meetings of the Board of Directors shall be held no less than three times a year upon call of the President or in his or her absence by the Vice-President, or by the Secretary upon the request of four or more directors. Notice of Meetings shall be sent by first-class mail, email, or delivered personally to each director, at least twenty-one days prior to the date of the meeting. In the event of an emergency, this twenty-one-day notice period may be waived by the caller of the meeting, provided all directors are contacted and given the opportunity to vote A simple majority of the Board shall constitute a quorum.

ARTICLE VIII – Amendment

A. These By-Laws may be altered or amended at any annual or duly-called special meeting of the Corporation by two-thirds vote of members present; but no alteration or amendment shall be made unless the Notice of Meeting shall specify the language thereof. The Secretary shall also include in the notice any proposed alteration or amendment which may be submitted to him or her in writing by no fewer than ten members.

ARTICLE IX – Parliamentary Authority

In all matters not covered by these By-Laws, the Parliamentary Authority shall be the most recent edition of Robert’s Rules of Order, to the best of our ability.

ARTICLE X – Dissolution

In the event of the dissolution of Great East Lake Improvement Association, its assets shall be given to another association whose purposes are similar.

ARTICLE XI – Enabling Clause

These By-Laws shall become effective as soon as adopted.

GELIA Conflict of Interest Policy

Adopted July 2014, Revised October 2022

Article I

Purpose

The purpose of the conflict of interest policy is to protect this tax-exempt Organization’s interest when it is contemplating entering into a transaction or arrangement that might benefit the private interest of an officer or director of the Organization or might result in a possible excess benefit transaction. This policy is intended to supplement but not replace any applicable state and federal laws governing conflict of interest applicable to nonprofit and charitable organizations.

Article II

Definitions

Interested Person. Any director, principal officer, or member of a committee with governing board delegated powers, who has a direct or indirect financial interest, as defined below, is an interested person.

Financial Interest. A person has a financial interest if the person has, directly or indirectly, through business, investment, or family:

a. An ownership or investment interest in any entity with which the Organization has a transaction or arrangement,

b. A compensation arrangement with the Organization or with any entity or individual with which the Organization has a transaction or arrangement, or

c. A potential ownership or investment interest in, or compensation arrangement with, any entity or individual with which the Organization is negotiating a transaction or arrangement.

Compensation includes direct and indirect remuneration as well as gifts or favors that are not insubstantial.

A financial interest is not necessarily a conflict of interest. Article III, Section 2, a person who has a financial interest may have a conflict of interest only if the appropriate governing board or committee decides that a conflict of interest exists.

Article III

Procedures

1. Duty to Disclose. In connection with any actual or possible conflict of interest, an interested person must disclose the existence of the financial interest and be given the opportunity to disclose all material facts to the directors and members of committees with governing board delegated powers considering the proposed transaction or arrangement.

2. Determining Whether a Conflict of Interest Exists. After disclosure of the financial interest and all material facts, and after any discussion with the interested person, he/she shall leave the governing board or committee meeting while the determination of a conflict of interest is discussed and voted upon. The remaining board or committee members shall decide if a conflict of interest exists.

3. Procedures for Addressing the Conflict of Interest

a. An interested person may make a presentation at the governing board or committee meeting, but after the presentation, he/she shall leave the meeting during the discussion and the vote on the transaction or arrangement involving the possible conflict of interest.

b. The chairperson of the governing board or committee shall, if appropriate, appoint a disinterested person or committee to investigate alternatives to the proposed transaction or arrangement.

c. After exercising due diligence, the governing board or committee shall determine whether the Organization can obtain with reasonable efforts a more advantageous transaction or arrangement from a person or entity that would not give rise to a conflict of interest.

d. If a more advantageous transaction or arrangement is not reasonably possible under circumstances not producing a conflict of interest, the Board of Directors or committee shall determine by a two-thirds majority vote of the disinterested directors whether the transaction or arrangement is in the Organization’s best interest, for its own benefit, and whether it is fair and reasonable. In conformity with the above determination it shall make its decision as to whether to enter into the transaction or arrangement.

4. Additional Requirements Under New Hampshire Law. Any possible conflict of interest on the part of any member of the board shall be disclosed in writing to the board and made a matter of record through an annual procedure and also when the interest involves a specific issue before the board.

Pursuant to New Hampshire RSA 7:19-a, I, a “pecuniary benefit transaction” means a transaction with a charitable trust in which a director, officer, or trustee of the charitable trust has a financial interest, whether direct or indirect. An indirect financial interest arises when a transaction involves a person or entity of which a director or a member of the immediate family of a director, is a proprietor, partner, employee, or officer.

Where such transaction involving a board member exceeds five hundred dollars ($500) but is less than five thousand dollars ($5,000) in a fiscal year, a two-thirds vote of the disinterested directors is required. Where such transaction exceeds five thousand dollars ($5,000) in a fiscal year, then a two-thirds vote of the disinterested board members and publication in the required newspaper is required. The minutes of the meeting shall reflect that a disclosure was made, the abstention from voting, and the actual vote itself.

For each such transactions in excess of five hundred dollars ($500), the board must maintain written minutes regarding the discussion and vote, including who was present, and the board must maintain a list of all such transactions and must annually report each such transaction to the Director of Charitable Trusts. For all such transactions with a value of more than five thousand dollar ($5,000), the board must notify the Director of Charitable Trusts before consummating the transaction. Every new member of the board will be advised of this policy upon entering the duties of his or her office, and shall sign a statement acknowledging, understanding of agreement to this policy. The board will comply with all requirements of New Hampshire law in this area and the New Hampshire requirements are incorporated into and made a part of this policy statement.

All interested persons shall comply with all notice and requirements of New Hampshire RSA 7:19a and RSA 292:6a

4. Violations of the Conflicts of Interest Policy

a. If the Board of Directors or committee has reasonable cause to believe a member has failed to disclose actual or possible conflicts of interest, it shall inform the member of the basis for such belief and afford the member an opportunity to explain the alleged failure to disclose.

b. If, after hearing the member’s response and after making further investigation as warranted by the circumstances, the Board of Directors or committee determines the member has failed to disclose an actual or possible conflict of interest, it shall take appropriate disciplinary and corrective action.

Article IV

Records of Proceedings.

The minutes of the Board of Directors and all committees with board delegated powers shall contain:

a. The names of the persons who disclosed or otherwise were found to have a financial interest in connection with an actual or possible conflict of interest, the nature of the financial interest, any action taken to determine whether a conflict of interest was present, and the Board’s or committee’s decision as to whether a conflict of interest in fact existed.

b. The names of the persons who were present for discussions and votes relating to the transaction or arrangement, the content of the discussion, including any alternatives to the proposed transaction or arrangement, and a record of any votes taken in connection with the proceedings.

Article V

Compensation

a. A voting member of the Board of Directors who receives compensation, directly or indirectly, from the Organization for services is precluded from voting on matters pertaining to that member’s compensation.

b. A voting member of any committee whose jurisdiction includes compensation matters and who receives compensation, directly or indirectly, from the Organization for services is precluded from voting on matters pertaining to that member’s compensation.

c. No voting member of the Board of Directors or any committee whose jurisdiction includes compensation matters and who receives compensation, directly or indirectly, from the Organization, either individually or collectively, is prohibited from providing information to any committee regarding compensation.

Article VI

Annual Statements

Each director, principal officer and member of a committee with Board of Directors’ delegated powers shall annually sign a statement which affirms such person:

a. Has received a copy of the conflicts of interest policy,

b. Has read and understands the policy,

c. Has agreed to comply with the policy, and

d. Understands the Organization is charitable and in order to maintain its federal tax exemption it must engage primarily in activities which accomplish one or more of its tax-exempt purposes.

Article VII

Periodic Reviews

To ensure the Organization operates in a manner consistent with charitable purposes and does not engage in activities that could jeopardize its tax-exempt status, periodic reviews shall be conducted. The periodic reviews shall, at a minimum, include the following subjects:

a. Whether compensation arrangements and benefits are reasonable, based on competent survey information, and the result of arm’s length bargaining.

b. Whether partnerships, joint ventures, and arrangements with management organizations conform to the Organization’s written policies, are properly recorded, reflect reasonable investment or payments for goods and services, further charitable purposes and do not result in inurement, impermissible private benefit or in an excess benefit transaction.

Article VIII

Use of Outside Experts

When conducting the periodic reviews as provided for in Article VII, the Organization may, but need not, use outside advisors. If outside experts are used, their use shall not relieve the governing board of its responsibility for ensuring periodic reviews are conducted.